Are your contact sheets giving you the sort of data that helps you discover – and close – the right leads? Are you depending on the data from your contact sheet/lead scoring to find your prospects?

Are your contact sheets giving you the sort of data that helps you discover – and close – the right leads? Are you depending on the data from your contact sheet/lead scoring to find your prospects?

I recently asked 15 colleagues to define what a good contact sheet should reveal. I got 15 different answers. So what’s correct? Here is my take away:

- it’s obviously subjective. Different companies seek different data points. How do they choose? How do they know they aren’t annoying/rebuffing/ignoring good leads? Are they calibrating the data so they understand the type/amount of wastage?

- the pulled data does not offer true buy-cycle data, merely good guesses.

When I trial a few contact sheets to test different types – and try to trick the questions to reveal nothing – I realize that the sheets are asking for specious data. How does one company decide to ask for number of employees, and another ask for the company revenue? And since the close numbers are so low, what difference does it make?

I can easily fill out a form for a webinar from home, and not use my company data. I can easily use a different account – say, a gmail account – to sign up for anything I want and no one will know who I am or be able to reach me. I can sign up for my ‘boss,’ who, say, might use the conference room and my computer, to listen to the webinar with 10 others, and no one will know. I can sign up for myself, and just be comparing the new material with my vendor’s, so I can pass the data on to them and have no intention of buying anything (even though I look and act like a real prospect) and block all the rest of the incoming emails.

WHO IS FALLING OUT OF THE SYSTEM?

As a result of the debatable usefulness of the data collected, sellers have no idea who they are following, nurturing, or trying to make an appointment with. Or who/what they should be spending money on. They are ignoring great leads and nurturing some who will never close. And they don’t know the difference, so they call and nurture whoever comes up on their ‘lead scoring’ – another activity based on guesswork (or they’d be closing more sales, no?).

Here are the numbers that you may not be tracking: from first name, when attempting to get an appointment, you are closing .6758% of the collected names. From 100 names that you call approximately 15 times over 3 months (obviously there is nothing better to do), 97.5% don’t want an appointment. From the 2.5% who take an appointment, 17% will close at some point. That’s when I hear folks say, “I close 17%.’ Geesh. Anyone can close 17% from first appointment. Why aren’t you closing 17% from the total?

How many of the 97.5% that didn’t want an appointment were real prospects? You have no idea – and yet they fell out of the system.

It’s possible to determine if the Buying Decision Team is already on board, or not formed yet. It’s possible to determine if the visitor is seeking other solutions, or comparing price with your competition. I would deem this valuable data.

But current contact sheets are not set up for this sort of data collection, because they are attempting to place a solution to the ‘right’ sort of buyer and lowering the odds by placing leads in demographic categories and then guessing.

WHAT WOULD BE THE RIGHT DATA

What if the idea was to collect data on the behind-the-scenes activities that buyers were managing, and entering there? In other words, entering earlier in the buying path rather than at the tail end. If your realtor could help you from the moment you and your family started considering you might want to move, would you have more data, and a better relationship, than when they just come to you saying they want a 3 bedroom house?

Here is the killer question: how many good leads – real buyers – are you losing because you aren’t capturing the right data? And what would the right data capture look like?

I’ve developed a new contact sheet that has a decision facilitation basis that really – really – leads buyers to the exact data they need at the exact right time (based on the decision path, not the type of buyer they might be) and simply helps buyers manage their entire decision path – offline as well as on line, change management as well as solution choice. It’s different from what you’re using now. But simple to use. And easy to replace your current contact sheet.

Yes, it’s different from what you’ve been using for the past 3 years. Ask yourself: Do you want to influence leads

- at the point where you can offer them your solution data, and hope they’ll use it

- or at the point where they are making decisions based on their human, political, and company criteria, and be there at the right time and place with the right data for each stage of the buying path?

Call me to discuss my newest solution. Unless you really like the results you’re getting and are convinced nothing is falling out of the bottom.

sd

To read more about the offline buying decision path, read The Buyer’s Decision Path: why it’s important to sellers;

Why aren’t our prospects buying: the problem sales can’t solve;

Helping buyers choose the right Buying Decision Team: a case study.

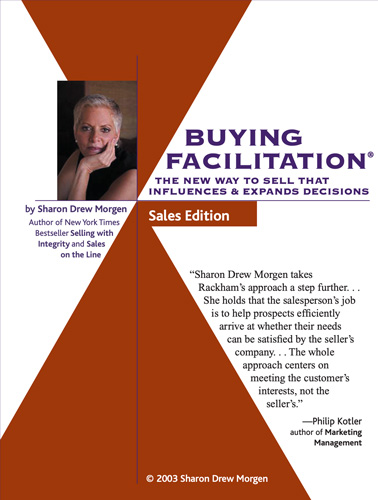

There are many ways to learn Buying Facilitation®:

- 3-Day Public Training in Austin June 8-10 Syllabus | Registration

- Buying Facilitation® corporate training

- Guided Study program for individuals or teams

- Learning Accelerators

3 thoughts on “Contact sheets: are they gathering the right data?”

Pingback: Marketing automation follows a small segment of the buying decision path | Sharon-Drew Morgen

Pingback: The results of using Buying Facilitation® | Sharon-Drew Morgen

Pingback: An Intelligent Contact Sheet | Sharon-Drew Morgen